|

The County of Los Angeles 401(k) Savings Plan is a powerful tool to

help you reach your retirement goals. As a supplement to other County

retirement/pension benefits that you may have, this voluntary Plan allows you to

save and invest extra money for retirement . tax-deferred!

Not only will you defer taxes immediately, you will save money

consistently and automatically, have a variety of investment options to

choose from, and learn more about investing for a secure financial future.

Read these highlights to learn more about your Plan, and how simple it is to

enroll. And, if you have any questions, visit this Web site or call a Client

Service Representative at (800) 947-0845.

Read the

Enrollment Planning Guide and complete a Participant Enrollment Form indicating

the amount you wish to contribute and your investment option(s) selection.

Please sign the form and return it to the County of Los Angeles Service Center,

500 North Central Avenue, Suite 220, Glendale, California 91203 (Office Hours:

Monday through Friday, 8:30am to 5:00pm Pacific Time).

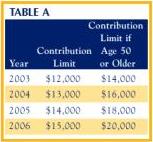

Your personal pre-tax contribution limit, effective on January 1st of each

year, is either the amount listed on Table A or 100% of Eligible Earnings as

defined by the Plan, whichever is less.

1) You may defer from 1% up to 100% of your Eligible Earnings in any one

month.

2) All deductions must be made as percentage of your Eligible Earnings

and rounded up to the highest tenth of a percentage (e.g., 8.6% but not

8.54%).

3) From 2007 to 2010, the annual contribution limit will be indexed

to inflation. The increases can only take place in $500 increments, and may not

occur every year.

The annual increase listed above will apply to you automatically unless you

defaulted or elected into the "low" contribution limit option. If you made

contributions to both the Savings Plan and the Horizons Plan, the contribution

limit option that you previously elected will remain in effect - the "low"

election will remain an $8,500 annual limit and the "high" election will reflect

Table A annual limits. If you decide to change your contribution limit option,

you must submit a completed Contribution Limit Option Form. You can obtain a

form by calling KeyTalk� at (800) 947-0845. Your payroll deductions become

effective the month following the date you submit your completed Participant

Enrollment Form. Since your contributions to the Savings Plan are made in

pre-tax dollars, they are not included in the gross wages category on your Form

W-2 but will be reflected as a pre-tax deduction on pay receipts issued on the

15th of the month following a deduction.

To support your efforts to save for retirement, the County will match your

contributions dollar-for-dollar up to 4% of your monthly "compensation" as

defined in the Plan. To receive the entire match, you must contribute a dollar

amount equivalent to at least 4% of your monthly compensation to the Plan.

The money you personally contribute to the Plan is always 100% vested. The

matching contributions made by the County are vested as shown in Table

B.

The Plan Administrative Committee invests the unvested portion of the

matching contributions, currently in the Stable Value Fund. You direct the

investment of vested matching contributions.

You can choose from fifteen investment options including three Pre-Assembled

Portfolios.

Please see the fund profile sheets for more information on the available

investment options, located in the Fund Options section of this Web site.

Investment Option information is also available through KeyTalk� at (800)

947-0845, 2 which is available to you 24 hours a day, 7 days a week. You can

also view investment option prospectuses on this Web site or obtain one from

your Client Service Representative.

Great-West Retirement Services® will mail

you a quarterly account statement showing your account balance and activity

within your account. You can also check your account balance and move assets

between investment options on this Web and KeyTalk� at (800)

947-0845.*

Use your Social Security number and Personal Identification Number (PIN) to

access either this Web site at or KeyTalk� at (800) 947-0845.*

You can:

move all or a portion of your existing balances between investment options

(subject to Plan rules/ fees)

change how future deferrals are allocated

change your deferral percentage

set-up custom transfers and automatic account rebalancing

The money you have invested in the Plan as well as your vested County

contributions can be withdrawn upon the following events:

retirement

disability

death of participant

termination of employment with the County

You may also be eligible to access your money via a loan, in-service

withdrawal or hardship withdrawal.

Loans

As an active participant, you may take out a loan

against the vested portion of your account if your vested account balance is

$2,500 or more. There are two types of loans available - general purpose loans

and real estate/home purchase loans (for the purchase of your principal

residence only). General purpose loans must be repaid within 5 years. Real

estate/home purchase loans must be repaid within 15 years. You may have only

two loans outstanding at any time.

In-Service Withdrawals

Provided you meet the requirements

outlined below, you may be eligible for an in-service withdrawal. You may only

make two in-service withdrawals per calendar year.

If you have been a participant for 10 years, you may withdraw all or part of

your vested County matching contributions. If you have withdrawn all your

matching contributions and have reached age 59�, you may withdraw all or a part

of the money that you have contributed to your account. You must select the

specific dollar amount as well as the funds from which the money will be

withdrawn.

All distributions from a qualified retirement plan that are eligible for

rollover but are not rolled over are subject to a mandatory 20% federal income

tax withholding. If you roll your full account balance directly into an IRA or

another qualified account that accepts such rollovers, no federal income tax

will be withheld.

Hardship Withdrawals

If you are experiencing severe

financial difficulties, and you do not qualify for a Plan loan, you may apply

for a hardship withdrawal. There are severe restrictions on hardship withdrawals

under Internal Revenue Code rules. You may make a hardship withdrawal only if

you have immediate and heavy financial need caused by:

- Medical expenses for you, your spouse, or dependents that were not

reimbursed,

- Payment of tuition for the next semester or quarter of post-secondary

education for yourself, your spouse, or dependent,

- Purchase or construction of your principal residence, or

- The need to prevent imminent foreclosure or eviction from your principal

residence.

Hardship withdrawals will not be permitted for any other

reason.

Any withdrawals and distributions from your account (except for loans) are

subject to ordinary income taxes. If you take a withdrawal or distribution

before age 59�, you may be assessed an additional 10% federal income tax

penalty.

You have a variety

of payment methods to choose from - one is sure to meet your needs.

If your account balance is less than $5,000, you must take a lump-sum

distribution. If your account balance is $5,000 or more, you may elect to have

your distribution from the Plan paid to you in one or a combination of the

following payment methods:

Periodic payments made directly from your investment account not extending

for more than 15 years,

Annuity payments made by an insurance company,

A partial or full lump-sum payment of your entire account, or

You may roll your Plan assets into your new employer's Plan (if allowed) or

to an Individual Retirement Account (IRA).

If you select a combination of these options, you must specify at the time of

your selection how all funds are to be paid. For example, you may request to

receive $5,000 on your benefit commencement date and to receive the balance in

the form of an annuity. You may not request to receive $5,000 on your benefit

commencement date and then let Great-West Retirement Services® know at some later date how to pay out the balance of

your account.

For more details about the benefit payment options available to you, please

contact the County of Los Angeles Service Center.

Third-Party Administrator Fees

The

Great-West Retirement Services® third party

administrative (TPA) fee is deducted from your account in monthly

installments.

The TPA fee deducted from participant accounts reflect a subsidy that offsets

the actual cost of the third party administrative fee charged to the Plan. The

Savings Plan Administrative Committee determines annually the availability and

amount of the subsidy, contingent upon the Savings Plan reserve balance.

County Administration Fees

County administration fees

must be paid by Plan participants. These fees are based on the actual cost of

services provided by the County to the Plan. They may vary and are deducted

quarterly from each participant's account in proportion to the total Plan

assets.

Plan administration fees will be deducted from fund balances in this order:

- City National Bank Fund

- Stable Value Fund

- BlackRock Core Bond Portfolio

- PIMCO High Yield Fund

- Dodge and Cox Balanced Fund

- MSIF Trust Value: INST

- SSGA S&P 500 Flagship Fund

- TCW Concentrated Core Equities

- ICAP Equity Portfolio

- ICM Small Company

- T. Rowe Price International Stock Fund

- T. Rowe Price New Horizons Fund

- Aggressive Pre-Assembled Portfolio

- Moderate Pre-Assembled Portfolio

- Conservative Pre-Assembled Portfolio

Loan Initiation Fee

There is a fee of $75.00 for

initiating and maintaining a loan, which is subtracted from the net loan check

amount.

Fund Management Fees**

Some of the funds

available to you will assess a fund management fee. These fees are disclosed in

the prospectuses issued by the individual mutual fund managers and are netted

from the mutual fund earnings by the mutual fund companies prior to establishing

their share price.

Offsets

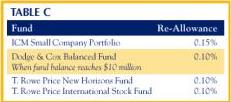

The County has negotiated the following fund

re-allowances from the investment companies as listed below. This re-allowance

amount is reimbursed back to the Plan and credited to participant accounts with

assets in the funds shown in Table C.

For an explanation of re-allowances, please refer to the specific fund's

prospectus

There are restrictions if you attempt to defer 100% of your

Eligible Earnings in any one month. Contributions to the LACERA or Judges

retirement plan and your flexible benefit program are taken out before Savings

Plan deferrals are made. You should also be aware that Savings Plan deferrals

take precedence over Horizons Plan deferrals - you should make an allowance in

your Savings Plan deferral for the dollar amount you plan to defer into the

Horizons Plan.

*Access to KeyTalk� and the Web site may be

limited or unavailable during periods of peak demand, market volatility, systems

upgrades/maintenance, or other reasons. Transfer requests made by Web site or

via KeyTalk� received prior to 1pm Pacific Time on business days will be

initiated at the close of the business day. Transfer requests received after 1pm

Pacific Time on business days, any time on a non-business day, or on days when

the market closes early, will be initiated at the close of business the next

day. The actual effective date of your transaction may vary depending on the

investment option selected.

**Prospectuses contain information about a

particular investment option, including fees and expenses. Read them carefully

before investing.

Withdrawals made prior to age 59� may be subject to a 10%

federal income tax penalty. All withdrawals are subject to ordinary income

tax.

Investment options have been selected by the Plan

Administrative Committee. Securities, when offered, are offered through GWFS

Equities, Inc., a wholly owned subsidiary of Great-West Life & Annuity

Insurance Company and a broker/dealer member of the FINRA. For more information

about available investment options, including fees and expenses, you may obtain

applicable prospectuses from your registered representative. Read them carefully

before investing. Not for use in New York.

|