|

The earlier you start saving, the more money you are likely to have for your

future. Tax-deferred saving and the power of compounded earnings do much of the

work for you. With tax-deferred saving, your money has the potential to grow

without being reduced by current taxes. With the added benefit of compounding,

any earnings on your contributions are reinvested into your account, where they

may continue to grow.

Investing wisely and setting realistic goals are key to successful saving.

But starting today can make a big difference.

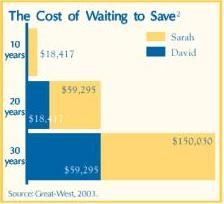

Consider this example: Sarah and David plan to retire in 30

years. Sarah starts saving $100 a month immediately. David waits 10 years before

saving $100 a month. The chart to the right shows what they both would have

after 10, 20, and 30 years assuming an 8% annual rate of return, compounded

monthly, and no withdrawals.

If Sarah contributes $100 a month for the whole 30 years, she might have

$150,030! Whereas, with a 10 year delay in saving, David may have $59,295.

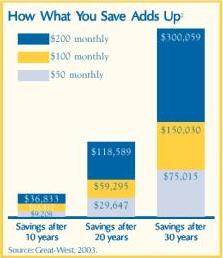

You may think that the amount you will contribute to your Plan will be

enough. But any additional amounts that you can contribute to this Plan may help

close the gap between your dreams and reality. The chart to the right shows how

just a small increase in your contribution level, and the power of compounding,

could mean thousands of dollars more over time.

Building savings for your future is made easier with County matching

contributions - you can receive up to an additional 4% of your compensation

towards your Savings Plan.

For illustrative purposes only. Does not represent the

performance of any specific investment option. Does not reflect any charges or

fees associated with your Plan. The accumulations illustrated here would be

reduced if fees had been deducted. Assumes 8% annual return compounded monthly

and no withdrawals.

|