|

It pays to

save through this Plan. Your contributions are taken out of your pay before

federal and California State income taxes are calculated, reducing your current

taxable income. So, you'll have more money in your pocket than if you were

saving the same amount with after-tax dollars.

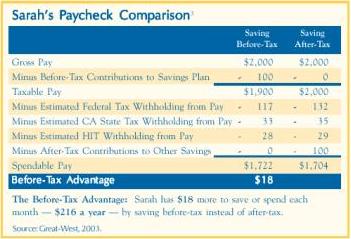

Consider this example: Sarah earns $2,000 a month in regular

pay and wants to invest $100 a month in the Plan. She's married, lives in

California, and takes one withholding allowance. Let's compare how much she

would save before-tax (through the Savings Plan) and after-tax (at a bank or in

some other savings).

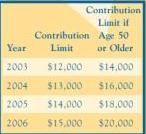

Should you choose to take full advantage of the tax savings available, you

can contribute up to the following personal pre-tax contributions limits

(excluding County matching contributions):

For illustrative purposes only. This hypothetical

illustration assumes a married participant taking one withholding allowance and

accounts for estimated federal, California state, and FICA tax withholding.

Additional limitations that apply to all contributions to

the Savings Plan

In 2003, federal tax law limits personal

contributions, matching contributions and after-tax contributions to the Savings

Plan to the lesser of $40,000 per year or 100% of Compensation, as defined by

the Plan.

|